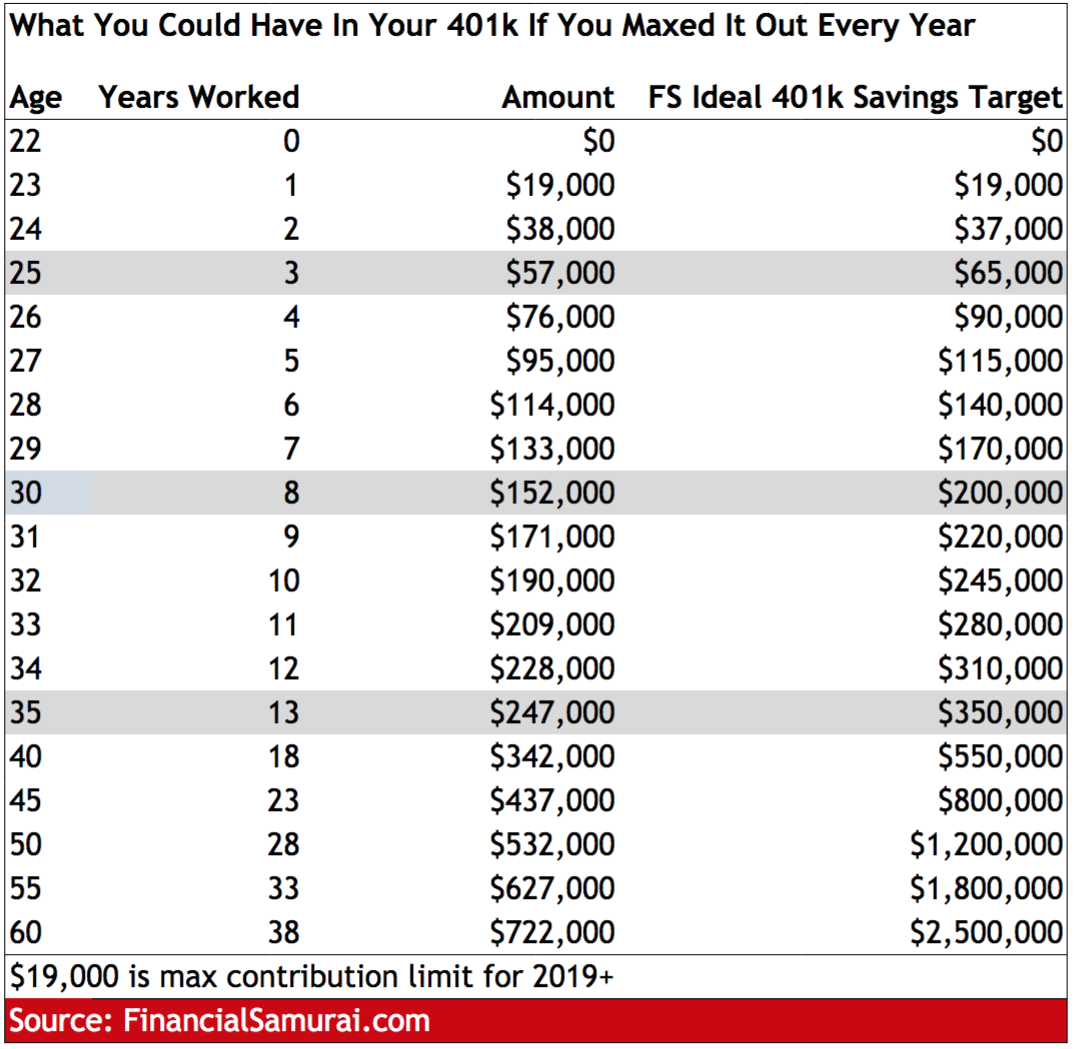

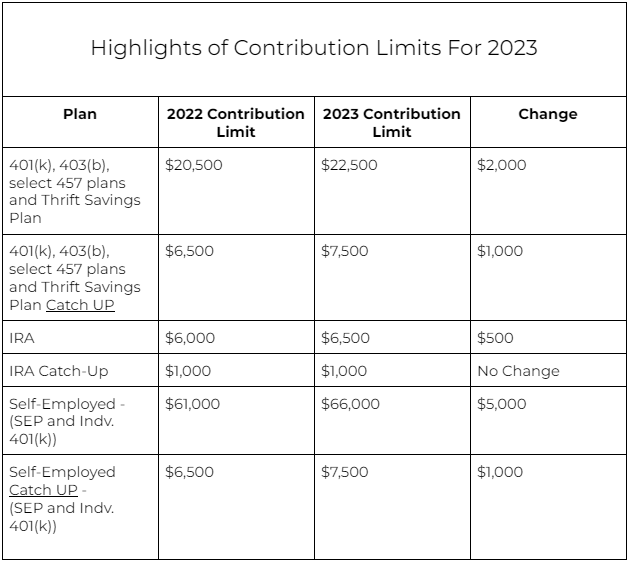

2025 Ira Contribution Limits 401k Fidelity. The 401(k) contribution limit is $23,000. What are the contribution limits for 401(k)s?

The irs has limits on how much can be contributed to an ira. You can contribute to both a 401(k) and an ira, as long as you keep your contributions to certain limits.

Contribution Limit 401k 2025 Fidelity Margy Saundra, The irs has limits on how much can be contributed to an ira.

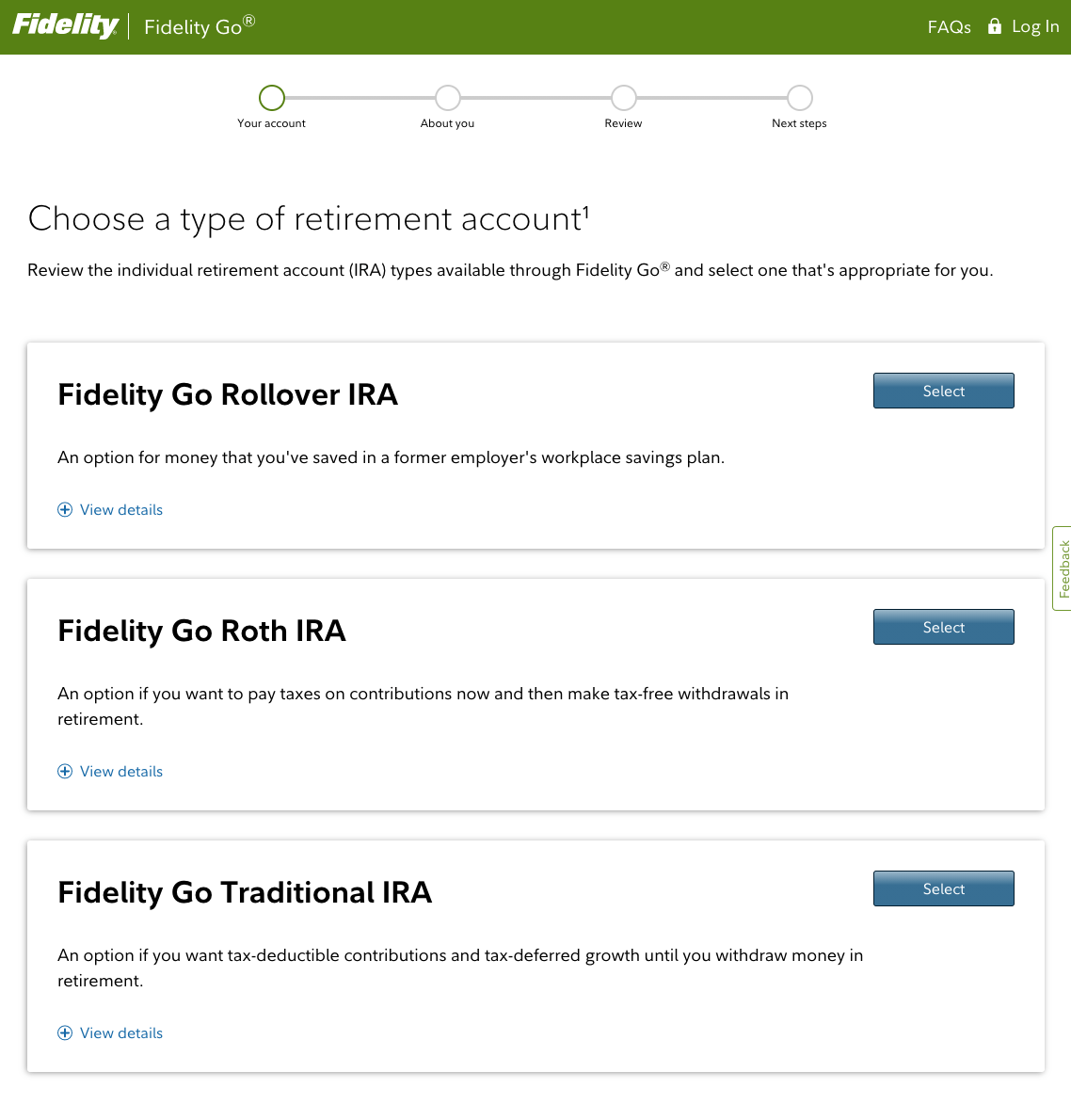

Ira Contribution Limits 2025 Chart Fidelity Heida Kristan, The irs has limits on how much can be contributed to an ira.

2025 401k Limits Chart Fidelity Melly Sonnnie, In 2025, your total contributions to all iras cannot be more than $7,000 if you are age 49 or younger and $8,000.

2025 Contribution Limits 401k Catch Up Fidelity Meade Jocelyn, You can contribute to an ira at any age.

Roth Ira Limits 2025 Fidelity Gisele Gabriela, Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift savings plan can contribute up to $23,000 in 2025, a $500 increase from the $22,500 limit in 2025.

2025 ira contribution limits Inflation Protection, The contribution limit for simple 401k and simple ira plans is $16,000 in 2025.

2025 Roth Ira Contribution Limits 401k Fidelity Dasie Emmalyn, You can contribute to both a 401(k) and an ira, as long as you keep your contributions to certain limits.

401k Contribution Limits 2025 Including Employer Match Linn Shelli, Roth ira contribution limits are somewhat higher for 2025, compared to previous years, and people who earn a taxable income are allowed to contribute up to $7,000 across.